Create a budget: This is one of those tasks in our household that is right up there with brushing your teeth. It is a must-do, and it is on the calendar every week. Every Sunday, I make a meal plan for the week, and I refine our weekly budget. Out of this process I developed a cash flow management program called Green Sherpa. It helps me stay on track so that I don’t overspend.

Don't Spend Beyond the Essentials

I call this my barebones budget. It is as if I am in college all over again. What are the must haves and the nice-to-haves? One really great exercise is to pull out a big piece of butcher paper and divide it into four parts. Upper left corner is must haves, upper right corner is nice-to-haves, lower left corner is short-term wants and lower right corner is long-term wants. Do this as a family if you have older kids or with your spouse/partner. It is a great exercise for getting on the same page financially. It is always eye-opening when you discover what is a nice to have for your spouse is a must have for you. When you come to an agreement around these items, put the must haves in your budget and only spend on those items for a month. How does that feel?

Learn to Say "No" to Some Financial Requests

One of the biggest lessons that my mom taught me was to say, “No.” When my daughter’s preschool asked for donations for a new garden, my tendency was to go to Home Depot and get some great Italian pots. Instead, I practiced a version of “No.” Instead of spending extra money, I went into our backyard and got some of our old pots and had the kids do great handprints all over them. They were a hit! Today, practice saying no to anything that requires extra time or money from you. How does that feel?

Reassess your Property Taxes

If the value of your home is falling, call the County Assessor's Office and request a reassessment. It could lower your property taxes. You don’t need to use a service to do this. You can request a reassessment on your own property on your own and it takes about 10 minutes to complete the forms.

Call Your Insurance Agent

Review health, home, and auto insurance, increasing deductibles and making other cost-saving changes where possible. I adore my insurance agent. He actually calls me with cost-saving changes for our policies. If you don’t have a close relationship with your insurance agent, create one. Call them and let them know that you would like to be updated for any changes that you can make in your policies over time that will save your family money.

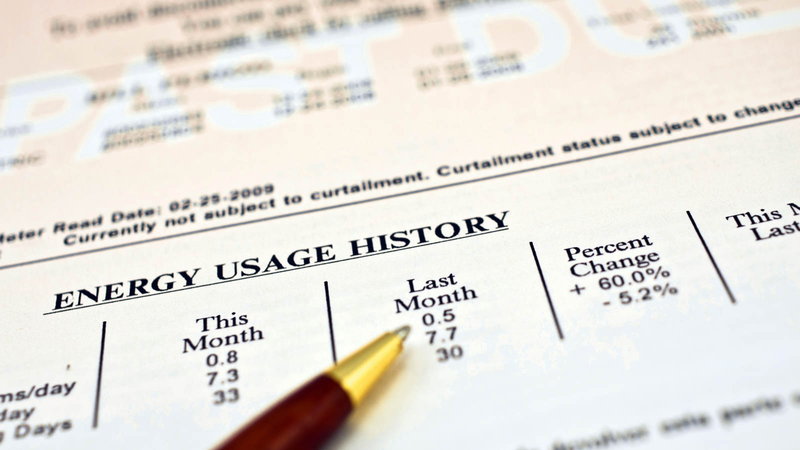

Lower Your Utility Bills

Review your utility bills such as water and electricity; request a reassessment of monthly usage estimates, potentially lowering the cost. In my city, the water company will come out and do a free evaluation of your water usage. When we did this, we made changes that they suggested and it cut our water bills in half! The gas company will do the same. Turning off your pilot light during summer months for your heater can make a huge difference in your gas bill. More tips like these can be gained by spending the time talking to each one of your utility companies.

Lower Your Cable Bill

Cancel cable TV subscription, or lower service to basic from premium. When I called to cancel our cable TV subscription (we have moved entirely online) the cable company offered us 2 free months of service. They also offered us our same package for lower rates. Just one phone call can save your family a significant amount of money.

Let Go of Your Landline

Cancel your landline telephone if you use a cell phone. This may be a generational difference but more and more people that I know are simply canceling their landlines and only using their cellphone. We have replaced the money that we used to spend on our landline with a date night dinner once a month.

Eat at Home

I cannot stress this enough. You will feel more resourceful and financially empowered by simply making your lunches and dinners at home. This alone can save hundreds of dollars each month (most likely more).

Buy Local

Most farmers markets and local meat and fish markets are open to offers. Offer $15 for multiple food items at farmers market instead of the $25 if you buy the items individually. By buying locally you open yourself up to relationships based on negotiation and bartering and not simply paying market prices.

Sell Items of Value that You Don't Use

Every time I go into our garage, I find more items to sell on Craigslist. It is an ongoing joke in our house that nothing is safe for very long in the garage. I create a “Sell” box and a “Maybe” box. I close the “Maybe” box and sell the other items. If I can’t remember what is in the “Maybe” box the following week, I sell those items too. We have simply become too attached to things that just don’t mean much to us these days. Let someone else enjoy these items and make money doing it.

Place What Money You Can in an Emergency Savings Account

These may be overstated but take whatever reserves you have, even if it is $10, and put that into a savings account. What has always helped me is setting up an automatic transfer from my checking into my savings. When times are lean, it may be $5, but slowly you can increase it. It is amazing to see the results of regular saving on your sense of fiscal well being. Try it!